Originally published on LinkedIn August 24, 2018

Now more than ever, the change is glaring. Automation, crowdsourcing and outsourcing simultaneously underscore the importance and repercussion of tech in society. The change is permanent, so there’s no need to romanticize. Yesterdays jobs are gone, today’s are slowing going and tomorrows are here, with more to come. The most productive solution is to upgrade one’s skills and continually update. If not, tomorrows job market will relegate some employees with four year degrees and masters, to low or mid-level personnel. Today’s internet and its power to democratize as well as disintermediate, provides a level playing field for entrepreneurs to achieve great things. Perhaps they wouldn’t be as powerful, memorable or influential as 19th century industrialists, but with less capital, outliers could almost equate or surpass the fortunes of industrial age entrepreneurs. Simply put, you too could become today’s Carnegie, Rockefeller, Morgan, Mellon etc. Jan Koum did it!

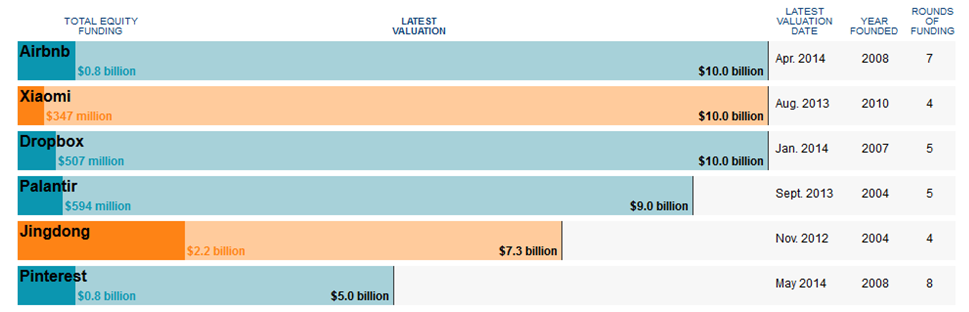

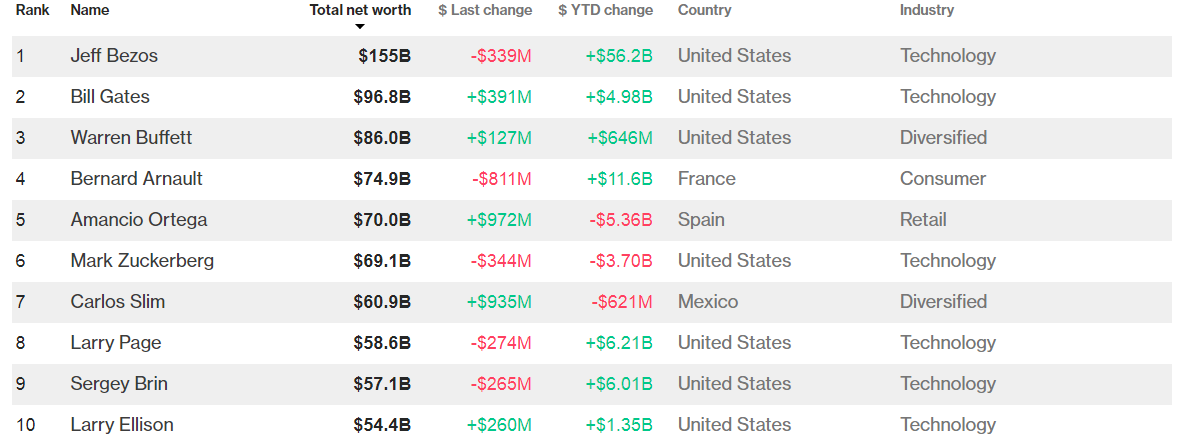

Since 2008, we’ve been living in an era in which big tech companies have been growing ever more powerful. Fewer players are conducting the global business orchestra, and their symphony is what the world listens and dances to. As more people around the world use smart phones, come online, buy devices, use social media; companies that are directly and indirectly involved will keep getting bigger. If the heading doesn’t capture you, these facts will (1) Apple the first $1 Trillion corporation (2) Jeff Bezos the first $100 Billion human (3) VANCL the first $1 Billion corp. Companies with $1 billion valuation are popularly referred to as Unicorns. These numbers are unprecedented, and we can all agree we’ve never seen their likes achieved in such a short period. Accuracy matters; there might have been another startup which became the first Unicorn in 2008 or 2009, according to this CB insights list, VANCL was first. Feel free to contact me to change it.

Backdrop 1847-1928

We are all familiar with, or perhaps have heard of Andrew Carnegie, John D Rockefeller, JP Morgan, Vanderbilt and others. These men were born during the 19th century, and were able to leverage and capitalize on the embryonic stage and growth of the industrial era. Their specific industries were rail roads, steel, banking, coal mining, electricity and later, mass production of cars by Henry Ford. Back then, few men controlled the European and American growth engines, which unquestionably made them and their future heirs extremely wealthy for multiple decades. Some may say, well things have changed, yes and no; yes a newer and more diverse version of the 1%, still control vast fortunes globally. Lest we delude ourselves; connections, money, power and the inequalities of 1800s which made things happen, are still very much alive today globally. Fortunately and unfortunately, depending on one’s family background; they will remain huge factors for centuries.

Old School Industrialists

Modern Day Industrialists

He Xiangjiang Elon Musk Aliko Dangote Lakshmi Mittal Carlos Slim Mukesh Ambani

It’s just an arbitrary list, Koch brothers; the consummate industrialists, Jeff Bezos, Jack Ma and Steve Jobs could have been part of the six.

To a large degree, today’s internet opportunity somewhat reduces the weight of connections, money and power of late 1800s, if you don’t believe it, read about the beginnings of the Google founders, Larry and Sergey, Jack Ma the CEO of Alibaba, Larry Ellison, Steve Jobs, Elon Musk and Jan Koum. As mentioned above, there were a handful of exceptionally powerful men running the show then. Today there are more billionaires and several internet millionaires globally. As such, their corporate exploits have increased global GDP.

Changing Times

This is an era of a new breed of royalty (tech royalty) that is. New monarchies are being created, leading to new Kings and Queens sitting on Unicorn thrones. Consequently, the foundation of wealth for two to three centuries are being formed in a matter of decades. Bloodline, family name and old money are no longer the prerequisites to ascend to modern day aristocratic level. In the modern world; brain power, software or technology, creativity, resilience and ambition are the currencies which open doors and maintain the new order. Hence, anyone or most people have a chance to compete.

Encouraging Times

Democratization of information, open source tools, new modes of thinking, Angel/VCs, accelerators, incubators and STEM education, all contribute to the relative ease of starting a tech business. Anyone anywhere can start a brand new company, if it catches enough fire, the likelihood of investors hearing about it and investing is much higher. The current rate of success and billion dollar valuation is a relative healthy sign for all. As the upper crust companies go up valuation, the value for new companies increase. View some Unicorns here http://graphics.wsj.com/billion-dollar-club/

A Global Phenomenon

“Our imaginations are our only limitations.” The cost of starting tech businesses have dropped dramatically from twenty and even ten years ago. Albeit it still cost a lot for most, which may be prohibitive. However, creative thinking, negotiations, savings, retirement or 401k, credit cards, crowd funding, parents, accelerators, Angel investors and VCs are there to help level the playing field. If it’s a great idea and you stay the course, great things should surely happen. During the industrial age, you had to be a caucasian male who was well connected with huge funding. Today those barriers are to some degree, less important. Hence, anyone from any background has the ability to change the course of their destiny and future generation as a result of coming up with great ideas which change the world. Although we’ve decided to highlight the most successful in the world, there are many more internet entrepreneurs who sold their businesses for $5 to $500 million etc. By any measure, that is still a huge success. MySpace sold to News Corp for $560 in 2005. Internet success stories are not isolated to North America, Europe and Asia. Here are some millionaires from different African countries Tech is global, and we are living in the greatest times of our lives and anyone can do it, being wildly successful is another story.

How Does The Internet Provide Opportunities?

There are 7 billion people in the world, and circa 2.5 billion online. There are over 1 billion smartphones and the growth hasn’t stopped. There’s a huge market and appetite out there, if one creates something of value and it rises up to outshine the competition, funding is almost guaranteed and hopefully, the rest should be history.

How Do I Join The Party?

Where or How Do I Start?

Start small, invest in Bitcoin via www.coinbase.com Crypto currencies or Blockchain related Corp. Conservatively, invest in tech firms via 401k plan.

Forbes: The World’s Billionaires Bloomberg: Billionaire’s Index 60 percent are in tech.

Being an industrialist is an achievement of epic proportions. Those corporations directly employ a lot of people, both blue and white color workers. Industrialists are felt, and seen as directly adding to the GDP of a country. Hence, their enormous power and influence whist alive, which enlarges their legacy after they die. However, being an industrialist requires huge capital investments, a certain type of character and it takes decades to get to the top. That’s the reason why, “Tech Is The New Industrial Age Opportunity.”

A.I., Machine Learning, Virtualization and Automation have up the ante. Hence, the subsequent words are written with great concern and humility; addressing African, South American and Arabic countries. If nations from these continents and regions get left behind again, the gap with which they’ll be overshadowed will be light years apart. Albeit, some are doing a great job of diversifying and using their oil wealth wisely to prepare for a future when the commodity is no longer valuable, or not enough to sustain global usage. It’s time! “Software is the New Oil.”

P.S. As of Monday August 20, this article was complete and ready to be published. Mysteriously, my fingers inadvertently deleted everything. Undo didn’t help because text is saved every few seconds as one types on LinkedIn. At the end, I redid everything at close to ninety to ninety five percent of the original document. Thanks for sharing and commenting.