Originally published on LinkedIn June 21, 2016

It’s a known fact, most people do not end up with their true love. However, having said that; if we marry someone with the qualities we seek, and hopefully by an order of significant magnitude, they happen to bring a lot to the table, compatibility included, that’s the first step toward marital bliss. As the years go by, memories of the person we initially wanted to marry fade away. The love triangle involving Microsoft, Salesforce and LinkedIn is analogous to the statement above.

Last Monday June 13, Microsoft married LinkedIn at the financial altar. It paid $26.2 billion cash to consummate the corporate union. Microsoft paid $196 per share in an all cash deal. Previously, Microsoft also considered buying Workday and LinkedIn, the latter which was successful. Microsoft must have desired this gorgeous beauty of a business called LinkedIn; not just as eye candy, or to show off to its peers, but because it paid almost fifty percent premium above where the stock was trading. The stock closed at $131 on Friday June 10, and sold for $196 on Monday June 13. Perhaps Microsoft was willing to go the extra mile because Salesforce was also interested in buying LinkedIn. The backstory, in 2015, Microsoft wanted to buy Salesforce for $50 billion, but the deal was unsuccessful due to Salesforce valuing itself at $70 billion. When the markets opened on Monday June 13, LinkedIn’s stock price rose more than 47%; LinkedIn went up nearly $61 to $192.

As written here LinkedIn The 100 Year Corp, if you bought and held the stock as a long term investment not a trade or speculative stock, then whatever was lost in April 2015 and February 2016 ($11 billion devaluation or 44% stock reduction) is slowing being recovered. Both charts may prove a point as to why LinkedIn sold, however there are always two sides to a coin. Although LinkedIn sold at a low point in its valuation, that doesn’t negate the fact it’s a 100 Year company on its own. The saying pressure bust pipes may apply, perhaps both charts could be illustrative of what would make a company want to sell at a vulnerable time. Kurt Wagner states three reasons why LinkedIn sold to Microsoft for $26 billion.

What’s the benefit for customers?

I would imagine the most important question is, will LinkedIn disappear, or will it be re-branded under Microsoft? No disappearance, LinkedIn will remain a standalone brand still controlled by the same management team, with CEO Jeff Weiner at the helm. However no board to report to, instead he reports to Nadella, Microsoft’s CEO. According to Satya Nadella’s comment, LinkedIn will be independent and integrated. As for the integration part, it will take months to play out, and we’ll all notice the execution in due time.

Perhaps improved productivity, richness of context and reduced time spent on specific tasks, resulting from integration. Microsoft’s Artificial Intelligence (AI) will be able to detect and serve relevant articles, depending on projects one is working on in real-time.

What does LinkedIn get?

- LinkedIn will retain its independence, brand, operational sovereignty and continue to do business as usual; similar to the deal it offered Lynda, which it purchased over a year ago. That seems to be the trend of successful acquisitions; especially with businesses which have built up cult following, or huge user base e.g., Google’s YouTube, Facebook’s What’sApp and Amazon’s Twitch etc. Besides the fact that this sort of independent but integrated M&A style works, could it be a tactic to evade FTC investigation, because they might be seen as impairing competition or being too monopolistic. It probably helps when the acquirer and potential target are perceived to be in non related businesses.

- Ability for its products to scale to Microsoft’s 1 billion plus user base. Perhaps that could work if one subscribes to LinkedIn premium and gets Microsoft Office 365, or the other way around. Obviously there might be a slight price increase to justify getting both services.

- Although LinkedIn had no direct competitors, as written in 2015 and I still maintain, it’s one of those companies that is unique enough to become a 100 year corporation. Unfortunately investor pressure and a degraded stock price, coupled with a premium buyout price at its lowest period were too irresistible. If it wanted to, it could have weathered the temporary storm alone. Wall Street would have had to ultimately adjust to a new norm.

What does Microsoft get?

Its new Total Addressable Market (TAM) is now $315 billion (slide 9), an increase of 58%. Any increase is good, but an almost 60% increase for a 41 year old blue-chip corporation is impressive. It gets a healthy business. LinkedIn’s 2016 Q1 total revenue increased 35% year-over-year to $861 million. For the full year, LinkedIn has increased its outlook and expects: Adjusted EBITDA of approximately $985 million – $1.005 billion, a 27% margin.

A growing business with more runway ahead for decades to come. I may have missed it, but an important piece of news I didn’t hear the media cover is, Microsoft not only acquired LinkedIn, it also got Lynda.com the biggest e-learning platform, in an industry estimated to be $107 billion (as of April 2015).

Acquisition helps Microsoft shift to cloud computing; now that it has a great asset or arsenal in its war chest.

As a productivity tool, Microsoft poses a big challenge to all competitors, because LinkedIn’s 433 million users now become acquired asset or members. The best part is, irrespective of how many times an employee changes their employer, or wherever they work in the world, as long as the new company uses Microsoft’s CRM, it’s as easy as ABC to switch on the productivity tap. Current and rich data about the world’s professionals, will be updated by the stake-holding professionals for free, you and I updating our profiles.

Finally, Microsoft can utilize its new asset (LinkedIn) and integrate into Skype, Outlook, Calendar, Windows Active directly and Office 365.

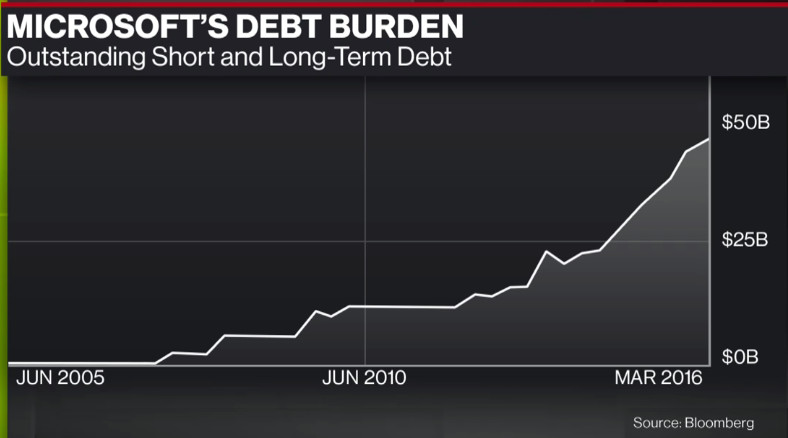

Perhaps it’s a better deal depending on how you view it. Just a year ago, Microsoft wanted to buy Salesforce so badly, it was willing to pay $50 billion. A year later, it has to take on additional debt, by the issuance of indebtedness to buy LinkedIn for $26 billion. Microsoft can now accelerate its CRM business for less; $29 billion instead of $50 billion for Salesforce.

How does Microsoft make money?

What’s the Return on Acquisition Price (ROAP). What’s the path to profitability and how will Microsoft convert this deal into a successful acquisition? Yes there’s a new $315 billion Total Addressable Market (TAM) slide 9, but by what method will it be accessed? Microsoft plans to improve its CRM value proposition and generate revenue from it. If Microsoft can edge out Salesforce, the number one CRM firm in the world, and take all its customers, then its likelihood of success is high, and 99.999 assured. However, that will be a tall order, or at least, it will take time. Currently, when people think of CRM, they automatically think Salesforce. Salesforce makes a lot of money on the top line, but doesn’t retain that much on the bottom line, because of customer acquisition cost and advertising. Hence if Microsoft can perform moderately well, what Salesforce spends in cost of acquiring users, Microsoft gains because it has the customers (LinkedIn members) in its database.

What does it mean for the competitors and the rest of the industry?

Microsoft just got a lot bigger, it may not seem that scary until one thinks about its different businesses and tentacles everywhere. CRM, office productivity tools, gaming, hardware, software, AI with Cortana and the list goes on. As incomprehensible as it may sound, Microsoft at 41 years old is still a relevant and nimble global powerhouse. Simply put, Microsoft is here to stay and not going anywhere. It just keeps getting bigger.

Although Microsoft now owns LinkedIn, it still has to do a lot of work in selling corporations to use its CRM. Marc Benioff, the CEO of Salesforce is exceptionally great at that. Watch him in action at the next Dreamforce.

How will this play out, given Microsoft’s acquisition and integration history?

There are two main factors at play, time and successful execution. Both will reveal if this was a great buy, and a genius idea. Competitors may be praying for Microsoft to mess this up, as some say it did with Nokia, and perhaps Skype as well as other acquisitions. However, Microsoft is under new management and this is a different era. Nonetheless, it cannot afford to make a blunder of this deal, because it will taint the brand and regress it; if not almost relegating it to the stodgy past it managed to shake itself from.

One of two things will happen, making a mess will have everyone saying huge M&As don’t work, and it will conjure up the AOL-Time Warner mishap. Conversely, it could set a precedence which will be hailed as the poster-child, that shows huge M&As can work if executed well. As written by Shira Ovide of Bloomberg Gadfly “The challenge for Microsoft now will be to prove it can own LinkedIn without breaking its new toy — something Microsoft does with alarming regularity.”

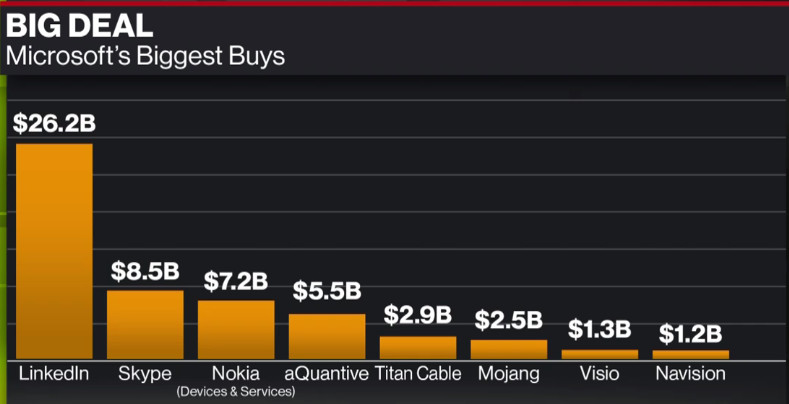

All of Microsoft’s biggest acquisitions the last seven, amount to $29.1 billion, which is 2.9 billion more than LinkedIn by itself. Another way of seeing that is, LinkedIn is 47% of the total amount of all Microsoft’s eight (over $1 billion acquisitions).

Source: Bloomberg

If you enjoyed this, you may find my first LinkedIn article interesting LinkedIn: The 100 Year Corp., and Lynda’s Acquisition